When is Bank Audit Required?

- Year-end financial reporting

- Bank funding or loan requirements

- Internal control and management review

- Periodic verification for large inventory-based businesses

Get Quote Here

WHAT IS A Bank AUDIT?

A bank audit is a systematic and independent examination of a bank’s financial statements, records, and operations to ensure their accuracy, integrity, and compliance with applicable laws, regulations, and accounting standards. The primary objective of a bank audit is to verify that the bank’s financial statements present a true and fair view of its financial position, performance, and cash flows.

A bank audit covers critical areas such as loans and advances, deposits, investments, income recognition, asset classification, provisioning for Non-Performing Assets (NPAs), internal controls, and risk management systems. Due to the sensitive nature of banking operations and public trust involved, bank audits are conducted under strict regulatory guidelines issued by authorities such as the Reserve Bank of India (RBI).

Bank audits are typically carried out by independent Chartered Accountants or audit firms appointed by regulatory authorities. The audit report plays a vital role in maintaining financial discipline, safeguarding depositor funds, ensuring regulatory compliance, and promoting transparency and accountability in the banking system.

In India, statutory bank audits are mandatory under the Banking Regulation Act, 1949, and other applicable laws, making them an essential component of the financial oversight framework of banks.

SCOPE OF BANK AUDIT SERVICES

• RBI circulars and guidelines

• Banking Regulation Act, 1949

• Accounting Standards (AS / Ind AS, as applicable)

• Standards on Auditing (SA) issued by ICAI

• Adherence to internal policies and RBI norms

• Early detection of irregularities and frauds

• Accuracy in day-to-day banking operations

• Internal control systems

• Risk management and governance framework

• Operational efficiency and compliance culture

• Deposits, advances, and cash transactions

• Verification of income and expenses

• Compliance with internal controls and RBI instructions

• Loan appraisal and sanctioning

• Documentation and security creation

• Monitoring, review, and recovery mechanisms

• Proper asset classification

• Adequate provisioning as per RBI norms

• Identification and reporting of NPAs

• Verification of interest income, fees, commissions, and charges

• Identification of income leakage

• Ensuring proper application of interest rates and charges

• Compliance with RBI Master Circulars and supervisory instructions

SCOPE OF BANK AUDIT SERVICES

• Reserve Bank of India (RBI) guidelines & Master Circulars

• Banking Regulation Act, 1949

• Companies Act, 2013

• Standards on Auditing (SAs) issued by ICAI

• FEMA, 1999

• NABARD guidelines (for cooperative and rural banks)

PURPOSE AND GOALS OF A BANK AUDIT

To Ensure True and Fair Financial Reporting

To Ensure Compliance with Banking Regulations

To Verify Loans and Advances

To Safeguard Depositors’ Funds

To Assess Internal Control Systems

To Detect and Prevent Errors and Fraud

To Ensure Proper Income Recognition

To Evaluate Investments and Treasury Operations

To Support Regulatory Oversight

To Enhance Transparency and Accountability

To Strengthen Risk Management

To Build Stakeholder Confidence

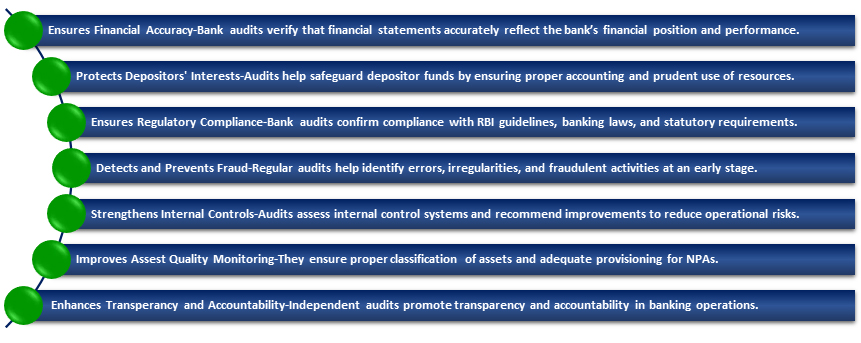

IMPORTANCE OF BANK AUDIT

KEY BENEFITS OF BANK AUDIT

1. Accurate Financial Reporting 📊

Ensures financial statements provide a true and fair view in compliance with RBI reporting standards.

2. Regulatory Compliance ✅

Confirms adherence to RBI Master Directions, circulars, and statutory norms.

3. Improved Asset Quality 🏦

Facilitates timely identification, classification, and management of NPAs under IRAC norms.

4. Stronger Internal Controls 🔒 Enhances effectiveness of internal control systems over operations and financial reporting.

5. Fraud Risk Mitigation 🕵️

Helps detect and prevent errors, irregularities, and fraud in banking operations.

6. Proper Income Recognition 💰

Ensures correct recognition of interest, fees, and other income as per RBI guidelines.

7. Effective Risk Management ⚖️

Strengthens monitoring and mitigation of credit, operational, market, and liquidity risks.

8. Regulatory Support 📑 Facilitates efficient supervision and reporting for RBI and other regulatory authorities.

9. Transparency & Accountability 🔍 Promotes transparent operations and governance at all management levels.

10. Depositor Protection 🛡️ Safeguards depositors’ funds through prudent financial management and compliance.

11. Operational Efficiency ⚡ Improves process discipline, compliance, and overall operational effectiveness.

12. Stakeholder Confidence 🤝 Builds trust among regulators, investors, and depositors through independent audit assurance.

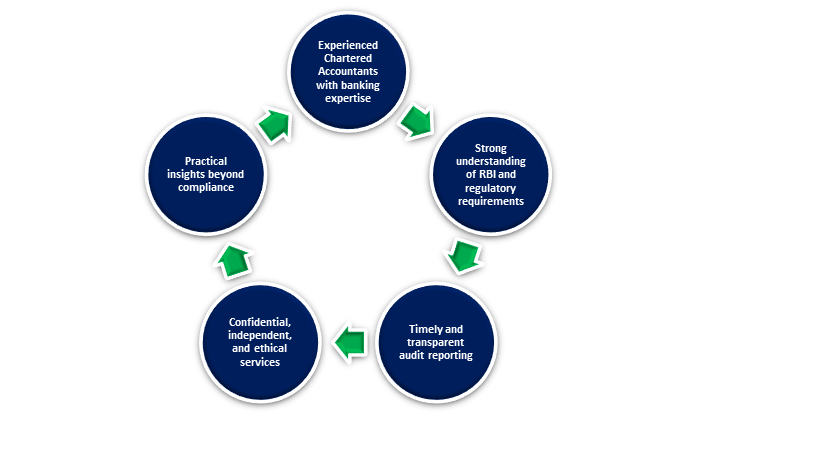

WHY CHOOSE US?

FREQUENTLY ASKED QUESTIONS (FAQs)

A Bank Audit is an independent examination of a bank’s financial statements, operations, and internal controls to ensure accuracy, transparency, and compliance with RBI guidelines, the Banking Regulation Act, 1949, and applicable Auditing Standards.

Bank audits ensure financial stability, regulatory compliance, transparency, and protection of depositors’ and stakeholders’ interests.

Bank audits in India are conducted by Chartered Accountants (CAs) who are appointed as per Reserve Bank of India (RBI) norms, ICAI guidelines, and applicable statutory provisions.

A statutory bank audit is a mandatory annual audit required under law to examine the bank’s financial statements and issue an audit opinion.

The scope includes verification of loans and advances, deposits, income recognition, asset classification, provisioning, investments, internal controls, and regulatory compliance.

Statutory bank audits are conducted annually, while other audits like concurrent and internal audits may be conducted monthly or quarterly.

It involves checking loan documentation, security, asset classification, interest recognition, and provisioning for non-performing assets (NPAs).

A Non-Performing Asset (NPA) is a loan where repayment has stopped. Identifying NPAs is crucial to ensure accurate provisioning and financial reporting.

The RBI issues audit guidelines, supervises banking operations, and ensures banks comply with regulatory and prudential norms.

Documents include balance sheets, profit and loss accounts, loan files, deposit records, investment statements, compliance reports, and statutory returns.

A concurrent audit is a continuous audit conducted alongside day-to-day banking operations to detect errors and irregularities promptly.

Adverse findings may lead to regulatory action, penalties, increased provisioning, management accountability, or restrictions imposed by regulators.

It enhances transparency, safeguards depositor funds, strengthens risk management, and builds confidence among regulators, investors, and customers.