When is GST Audit Required?

- Year-end financial reporting

- Bank funding or loan requirements

- Internal control and management review

- Periodic verification for large inventory-based businesses

Get Quote Here

WHAT IS GST AUDIT?

A GST Audit is a systematic and independent examination of a registered taxpayer’s books of accounts, GST returns, records, and supporting documents to verify the correctness of turnover, tax liability, Input Tax Credit (ITC), refunds, and overall compliance with the provisions of the GST law. GST Audit ensures that businesses are accurately complying with GST regulations as prescribed under the CGST Act, 2017 and Rules made thereunder.

TYPES OF GST AUDIT

Key features:

• Conducted at the taxpayer’s place of business or tax office

• Prior notice is issued

• Audit must be completed within prescribed timelines

• Findings are communicated to the taxpayer

Coverage includes:

• Returns filed

• Input Tax Credit (ITC) availed

• Tax payments

• Refunds claimed

• Transactions are complex

• Input Tax Credit (ITC) availed is excessive

• Valuation or classification issues exist

Important points:

• Conducted by a Chartered Accountant (CA) or Cost Accountant (CMA) nominated by the department

• Cost of audit is borne by the Government

• Audit report forms the basis for further

proceedings

Key aspects: • Focuses on discrepancies in GST returns • Taxpayer is issued a notice seeking explanation • Can lead to audit, investigation, or demand proceedings if discrepancies persist

Note: Mandatory statutory GST audit by professionals has been removed; however, departmental audits, scrutiny, and special audits continue under GST law.

OUR GST AUDIT SERVICES

• Review of GST returns (GSTR-1, GSTR-3B, GSTR-9, etc.)

• Reconciliation of turnover, ITC, and tax liability

• Verification of books of accounts and supporting documents

• Identification of errors, mismatches, and potential risks

• Drafting replies to GST audit notices and queries

• Representation before GST authorities

• Assistance in tax payment, refund issues, and rectifications

CONSEQUENCES OF GST AUDIT

• Short payment of tax

• Excess Input Tax Credit (ITC) claimed

• Incorrect classification or rate

The taxpayer must pay the differential tax.

• 18% per annum – normal cases

• 24% per annum – undue or excess Input Tax Credit

(ITC) wrongly availed and utilized Interest is mandatory and cannot be waived.

• Negligence, or

• Incorrect interpretation, or

• Suppression or fraud

Penalty proceedings may be initiated under Section 73 or 74.

• Bank account attachment

• Recovery from debtors

• Sale of goods or property

• Fines

• Imprisonment (for large tax evasion cases)

PENALTIES UNDER GST LAW

• Up to ₹25,000 (CGST ₹12,500 + SGST ₹12,500)

• If tax + interest paid before notice → No penalty

📌 Section 74 – Fraud / Willful Misstatement (Intentional tax evasion)

• Penalty: 100% of tax due

• Reduced penalty available if paid early:

o 15% before notice

o 25% within 30 days of order

o ₹50 per day (₹20 per day for Nil returns)

o Maximum: ₹5,000 (subject to notifications)

• Cancellation of GST registration

• Possible arrest in high-value cases

GST AUDIT COMPLIANCES

• Accurate and timely filing of:

GSTR-1

GSTR-3B

Annual Return (where applicable)

• Correct classification of goods/services and GST rates

• Proper documentation for:

Input Tax Credit (ITC) claims

Exempt supplies

Reverse Charge Mechanism (RCM)

• Preservation of records for at least 72 months

• Prompt and complete response to audit notices

SCOPE OF GST AUDIT

| S. No. | Area of Review | Scope / Activities |

|---|---|---|

| 1 | Turnover Verification |

|

| 2 | Tax Liability Review |

|

| 3 | Input Tax Credit (ITC) Examination |

|

| 4 | Return & Reconciliation Review |

|

| 5 | E-Invoicing & E-Way Bill Compliance |

|

| 6 | Refunds & Adjustments |

|

BENEFITS OF GST AUDIT

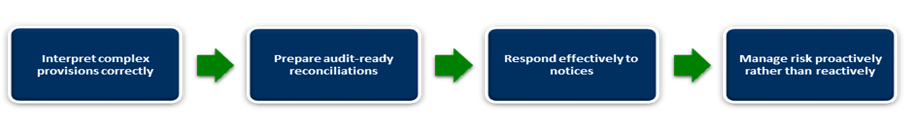

WHY PROFESSIONAL GST AUDIT SUPPORT IS IMPORTANT?

GST AUDIT CHECKLIST

| Area | Compliance Task | Frequency / Timeline | Responsible Person |

|---|---|---|---|

| GST Registration | Verify registration details & amendments | Annual / As needed | Accounts / Compliance |

| Books of Accounts | Maintain purchase, sales, ledger, and journal | Ongoing | Accounts |

| Invoices | Issue GST-compliant invoices & e-invoices | Per transaction | Accounts |

| Input Tax Credit (ITC) | Verify eligibility, blocked credits, and reversals | Monthly / Quarterly | Accounts |

| GSTR-1 & GSTR-3B | Reconcile returns with books | Monthly | Accounts |

| Annual Return (GSTR-9/9C) | Prepare and file annual return | Yearly | Accounts / CA |

| E-Way Bill | Ensure generation & validity for goods movement | Per dispatch | Logistics / Accounts |

| Refunds & Adjustments | Verify eligibility & supporting documents | As applicable | Accounts |

| Payment of Tax | Timely payment of GST & interest | Monthly / Quarterly | Accounts |

| Audit Records | Preserve records for at least 72 months | Ongoing | Accounts |

| Scrutiny / Notices | Track and respond to notices | As received | Compliance / CA |

| Internal Controls | Conduct periodic review and reconciliation | Quarterly | Accounts / Audit |

FREQUENTLY ASKED QUESTIONS (FAQs)

A GST Audit is an examination of a taxpayer’s books, returns, and records to verify correctness of turnover, tax paid, Input Tax Credit (ITC) claimed, and overall compliance under GST law.

- Businesses with turnover exceeding the threshold (as per the CGST Act)

- Businesses selected by authorities for special audit or scrutiny

- Audit by Tax Authorities (Sec 65)

- Special Audit by CA/CMA (Sec 66)

- Scrutiny of Returns (Sec 61)

- Turnover verification

- Tax liability assessment

- ITC eligibility & reversals

- Return reconciliation

- E-invoice & e-way bill compliance

- Refunds & adjustments

- Maintain accurate books and invoices

- Perform periodic reconciliations

- Respond to notices on time

- Retain all supporting documentation

- Ensures compliance and accuracy

- Minimizes penalties and interest

- Improves internal controls

- Reduces audit risk and litigation

At least 72 months from the due date of filing the annual return for the relevant financial year.

Ordered under Section 66, it is conducted by a Chartered Accountant or Cost Accountant appointed by the tax authorities for complex or high-risk transactions.

Yes, GST audit examines ITC claims for eligibility, blocked credits, and reversals to avoid mismatches with returns.

Statutory audit by professionals is no longer mandatory for all. However, departmental audits and scrutiny may still be conducted.

By ensuring accurate reporting reconciliation, ITC verification, and timely compliance, businesses reduce risk of penalties and interest.

Yes, the audit reviews e-invoice generation, IRN, validity, and matching with e-way bills for compliance.

Internal GST reviews or mock audits are recommended quarterly or before year-end filing to identify and rectify issues.

- Tax authorities for official audits

- Chartered Accountants (CA) / Cost Accountants (CMA) for special audits or voluntary review

Professional advisory helps in:

- Reviewing records and returns

- Performing reconciliations

- Preparing audit-ready documentation

- Responding effectively to notices